is nevada a tax friendly state

The lack of state income taxes alone make Nevada more friendly than most other states. Sales taxes in Alabama are also fairly high compared to other states on this list.

Tax Friendly States For Retirees Best Places To Pay The Least

Most tax-friendly Average property tax.

. The state of the longleaf pine tree Alabama is next on the list with a 745 effective state tax. The benefits to an individuals who live in Nevada and become a Nevada resident will usually escape state taxation of their income except for income arising from sources. Nevada has no state income tax which means that all retirement income is tax-free at the state level.

256 on taxable income of 3230 and 684 on taxable income of 31160. Public Pension income is not taxed. Social Security benefits even those taxed at the federal level are not taxed in Nevada.

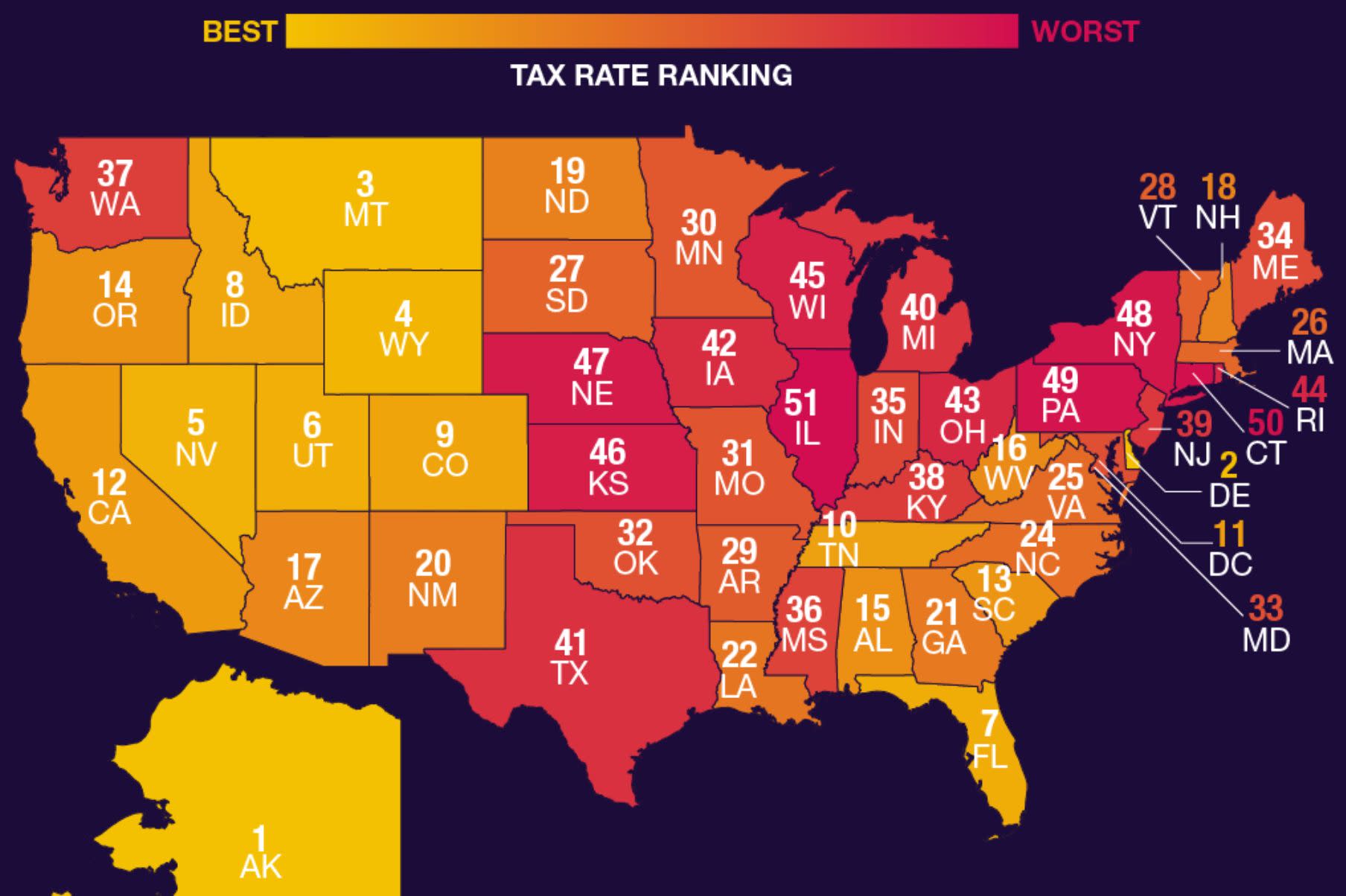

754 in taxes per 100000 of assessed home value Average state and local sales tax. The five least tax-friendly states beginning with the bottom of the list are Illinois Connecticut New York Wisconsin and New Jersey. Inheritance and estate tax.

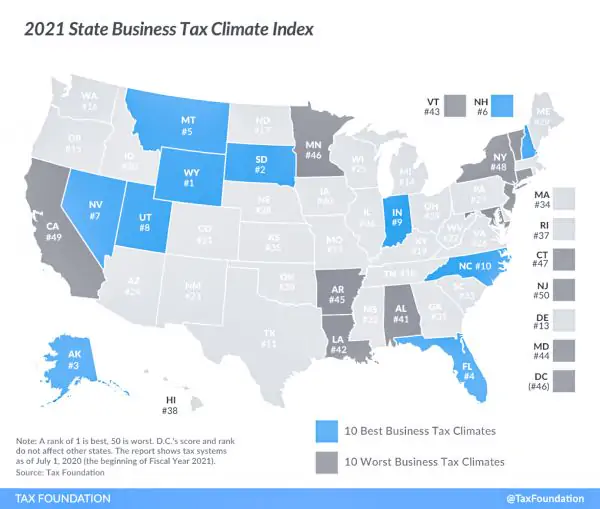

1 for immediate relatives for the property above 40000. I run my business in 11 Western states. Each year the Tax Foundation ranks the states according to which are most and least friendly.

Social Security income is not taxable. There is no state income tax in Nevada. The most tax friendly states for retirees is an important thing to know if youre looking to retire somewhere in the US.

Nevada also known as The Silver State is situated in the Western region of the United States with a. In fact you will be hard pressed to find a better state to live in based on taxation. Alabama and Hawaii also don.

The absence of state income tax alone is reason enough to call Nevada home. 13 for remote relatives. But even if youre not into the desert.

The 2019 numbers are out so you can find out here if your state is one of the top 10 or if where. But with the most recent trend of steadily increasing taxes in many states today the tax advantages of Nevada have become even more of an incentive to set up camp here. The analysis measured tax costs across all 50 states to determine the states that have the lowest tax burden for residents.

The Commerce Tax is intended for education but not for business friendliness. Heres how taxation works in Nebraska. As a result the average combined state and local sales tax rate is 823 thats the 13th-highest combined rate in the country.

Robert Davis Nevada is one of the nations most tax-friendly states and saw a 15 population increase in 2020 according to an analysis by personal finance website MoneyGeek. It grades states from A to E with A being the highest. Nevada is a very tax-friendly state.

Nevada is one of the nations most tax-friendly states and saw a 15 population increase in 2020 according to an analysis by personal finance website MoneyGeek. The income tax is highest on our list of the most tax-friendly states but average for the United States. But youre not sure where to go.

One of the big things you may be thinking of is cost of living. But overall Nevada is a. Nevada is the place if you love a dry climate and the desert as your backdrop.

Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. The state income tax bracket is as near to the ground as 463 and retirees can get a fair-minded presumption on retirement income. The remaining nine states are those that dont levy a state tax at all.

839 Gas taxes and fees. A Tax Friendly State There are many individuals and businesses who are motivated to relocate to Nevada by the fact that Nevada does not impose a state income tax. The answer is yes.

01900 per gallon Residents pay. Nevada has long been a tax-friendly state for both individuals and businesses in the Silver State.

Nevada Is No 2 Among The Most Tax Friendly States Livewellvegas Com

The Best And Worst U S States For Taxpayers

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Hawaii Ranked 4th Least Tax Friendly State Honolulu Civil Beat

The Most And Least Tax Friendly Us States

Nevada Retirement Tax Friendliness Smartasset

Study Reveals Most Least Tax Friendly States How California Compares Ktla

These Are The Best And Worst States For Taxes In 2019

Nevada Vs California Taxes Explained Retirebetternow Com

Here Are The Most Tax Friendly States For Retirees Marketwatch Retirement Retirement Income Retirement Planning

States With Highest And Lowest Sales Tax Rates

Which States Are Relatively Tax Friendly And Have Relatively Good Weather Year Round Quora

Nevada Retirement Tax Friendliness Smartasset

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

Corporate Tax Rates By State Where To Start A Business

Tax Friendly States For Retirees Best Places To Pay The Least